Today's Thursday • 8 mins read

— By Dr. Sandip Roy.

Money affects happiness in a way that’s both intuitive and endlessly confusing.

It feels obvious until you try to explain it. We want clean answers, but what we get is messy human psychology that refuses to cooperate with spreadsheets.

The relationship between your bank account and your well-being follows patterns, but those patterns often bend and shift depending on who you are and what you’ve lived through.

5 Hard Truths About Money & Happiness: Psychology of Wealth

Here are five ways money affects our happiness that you may be surprised by, as they will challenge some of your beliefs.

1. More Money Won’t Fix the Parts of Your Life That Aren’t About Money.

Money can’t repair the emotional, relational, or existential problems at the center of your unhappiness.

If you feel lonely, carry unresolved grief or chronic dissatisfaction, or face communication breakdowns in your relationships, a raise, an expensive purchase, or a sudden jackpot will only be temporary distractions.

The things that would actually heal those wounds require time, reflection, and someone to share your vulnerabilities with. Money can’t replace honest conversations, boundary-setting, or building meaningful habits.

That said, money can pay for therapy, create space to build new routines, and remove the stress that hijacks emotional energy. But the value lies in how you use that freedom.

Without intention and effort, money only smooths logistics, while the real problems stay exactly where they were.

People often expect wealth to fix loneliness, insecurity, or meaninglessness; what it actually does is remove the financial excuses that once disguised those problems.

2. Your Happiness Depends Less on How Much You Have and More on What You Compare Yourself To.

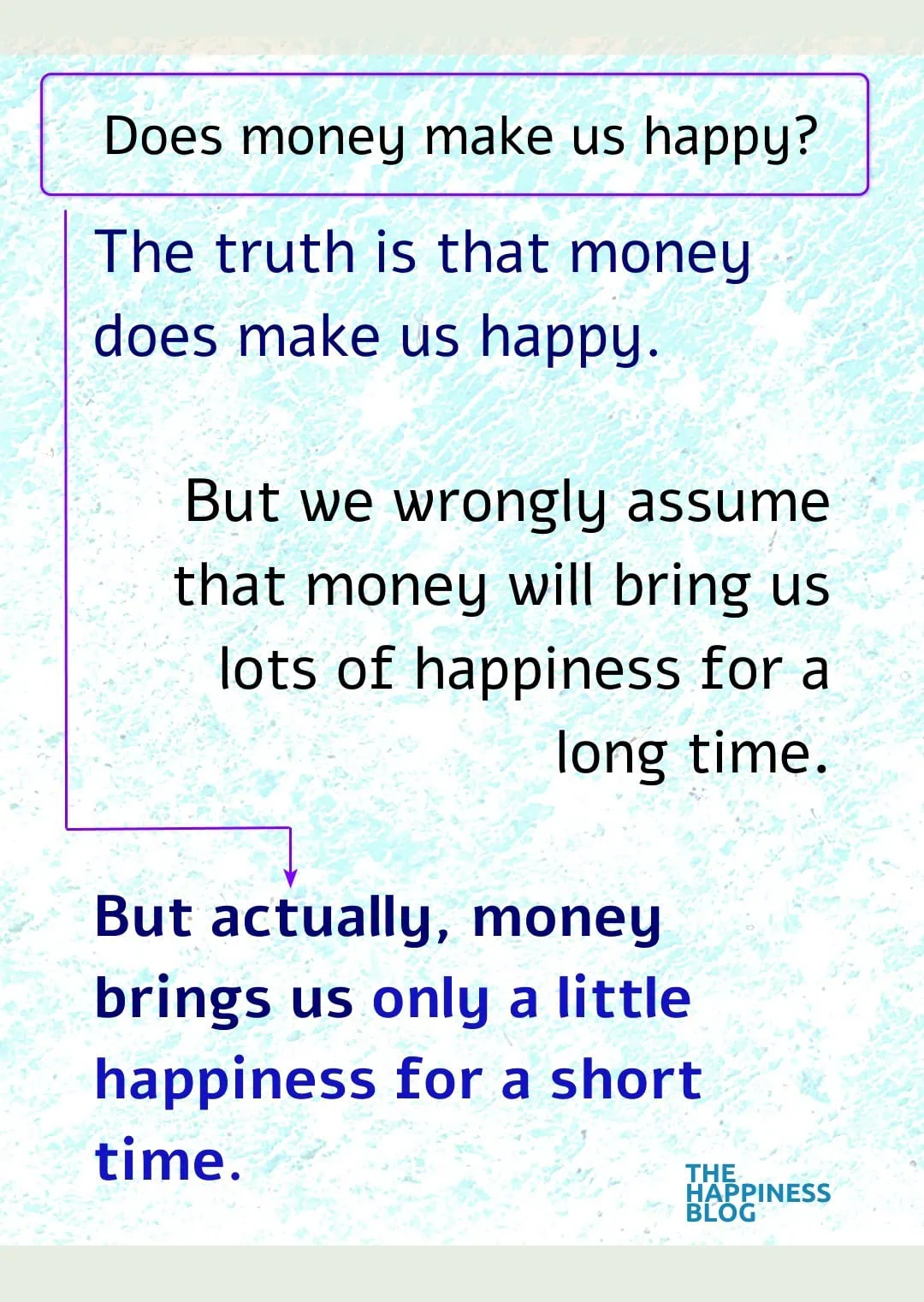

A salary bump that feels life-changing in January often feels routine by December. Why?

Because humans don’t measure financial well-being in raw numbers. We measure it against three moving targets:

- Our Past: Where we used to be.

- Our Peers: What the people around us have.

- Our Expectations: Where we thought we’d be by now.

First, it is the comparison trap. You compare your life to your friends’ career paths, influencers’ lifestyles, and an idealized future version of yourself who should have gotten there by now.

Those comparisons shape your emotional experience more than the actual dollar amount in your account.

Someone earning $60k can feel wealthy while someone earning $600k feels broke, simply because of the story they tell themselves about their neighbors.

Seconds, the idea of hedonic adaptation. We quickly adapt to our base level of happiness,

This explains why lottery winners often return to baseline happiness levels within a few years. And why people who lose their jobs can adapt to the new normal more quickly than expected.

We recalibrate. What felt like a miracle or a disaster becomes your new normal.

Our brain is remarkably efficient at adjusting to whatever circumstances we’re living in, which is both a gift and a curse. It helps us survive hardship, but it also means that the happiness boost from more money fades faster than we’d expect.

3. Money Reduces Unhappiness More Reliably Than It Creates Happiness

Money buys us freedom, while we think it buys us happiness.

The real value of money is in financial autonomy: having control over your life, not having hoards of cash.

Money gives us freedom of time, the ability to pursue work that fulfills us, the option to live where we choose, and the power to make decisions that let us flourish.

Actually, the happiness money brings is mostly from what it takes away. Money subtracts some major negatives from your life, like:

- Allowing you to quit a job that is grinding you down into burnout.

- Letting you buy back your time as it pays for childcare, elder care, and home services.

- Giving you the option to walk away from a toxic relationship without fearing homelessness.

We overvalue the short-lived pleasure of purchases but undervalue the lasting relief of money removing or life’s constraints.

Money that relieves survival and scarcity‑driven stress in our lives is far more valuable than the fleeting spikes from new purchases.

Emotional freedom is the quiet dividend of not worrying about the next bill and making choices based on values rather than fears.

There’s a floor below which money problems create genuine suffering. Getting above that floor matters enormously. But once you clear the survival floor, the curve flattens.

- The jump from crisis to stability is life-transforming.

- The jump from stability to luxury is mostly just a change of scenery.

This pattern of diminishing returns happens because you are no longer solving acute problems, but simply adding incremental comfort to an already comfortable life.

4. Your Beliefs About Money Are Shaped by Your Own Experiences, Fears, and Blind Spots

People report higher satisfaction when their spending choices align with specific priorities: experiences over objects, autonomy over status markers, connection over performance metrics, security over signals.

Personal finance is deeply personal. How you use money matters more than how much you have.

Your spending habits reflect your emotional architecture: your history, your wounds, and your dreams.

- The Saver: May feel genuine joy from a massive emergency fund because their priority is safety.

- The Spender: May get deep satisfaction from a luxury watch because it validates their hard work.

The Lesson: There is no universal law for “correct” spending. Your version of “enough” might be someone else’s version of “excess” or “deprivation.” No universal converter makes those views line up neatly.

Some people feel secure with a massive emergency fund, while others find that level of savings makes them feel like they’re not living fully.

The person spending $5,000 on a trip and the person spending $5,000 on a designer item are not wrong. They are both just optimizing for different emotional needs.

The one who spends $5k on a vacation might be investing in memories and relationships. The other one who spends the same on a watch might be satisfying a deep need for tangible proof of their success.

Happiness comes when your spending aligns with your specific emotional truth, not a generic rulebook.

5. Money Amplifies Who You Already Are

Money is a magnifier, not a filter. It doesn’t rewrite your personality; it reveals it.

- If you are generous: If generosity comes naturally to you, money lets you act on it at a larger scale.

- If you are anxious: If anxiety is your default setting, money multiplies the things you can worry about.

- If you are insecure: If you’re wired to track social status, money turns into a scoreboard you can’t stop refreshing.

Money doesn’t rewire your personality. It reveals what was already there, sometimes in ways you’d rather not see.

Insecure people don’t magically become confident when they get rich; they become insecure people with expensive liabilities.

People who chase status through money rarely feel satisfied in their lives.

Summary: 5 Truths About Money And Happiness

These five hard money truths feel uncomfortable because they’re both true and universal:

1. More money won’t fix the parts of your life that aren’t about money. People often expect wealth to heal loneliness, insecurity, or meaninglessness. It doesn’t. It just removes the financial excuses that once disguised those problems.

2. Your happiness depends less on how much you have and more on what you compare yourself to. If your expectations rise as fast as your income, which they usually do, you can feel stuck no matter how far you’ve climbed.

3. The happiness money brings is mostly from what it takes away—stress, fear, uncertainty. Freedom from chronic financial anxiety is powerful. But once that’s gone, the emotional “high” from more income fades fast.

4. Your beliefs about money are shaped by your own experiences, fears, and blind spots. What feels “responsible,” “risky,” “enough,” or “not enough” is emotionally driven and often irrational. Everyone’s a little delusional about money, just in their own unique way.

5. People who chase status through money rarely feel satisfied, because there’s always someone richer to feel threatened by. Status is a race without a finish line. The scoreboard resets every time you look around.

The Bottom Line: Financial advice that ignores your personality usually fails. The strategy that works for your disciplined friend might be agony for you. The budget that makes one person feel secure might make another feel suffocated.

Final Words

Managing your money is, ultimately, about managing your psychology.

Money buys happiness to the extent that it buys independence, removes chronic stressors, and lets you live in alignment with what you actually value.

The person you become with financial resources is mostly the person you already were, just with more options and fewer excuses.

Insecure people don’t become confident when they get rich. They become insecure people with expensive things they’re worried about losing.

• • •

√ Also Read: How To Leave A Narcissist, With No Money (And Be Free)

√ Please share this if you found it helpful.

» You deserve happiness! Choosing therapy could be your best decision.

...

• Disclosure: Buying via our links earns us a small commission.