Today's Friday • 12 mins read

“Money can’t buy happiness.”

The moment you say that, someone always chimes in, “They just don’t know where to shop for happiness!”

Those same people will happily declare, “I’d rather cry in a BMW than laugh on a bicycle.”

Americans spend about 2 hours and 18 minutes per day in worrisome thoughts, with 53% citing money as their primary source of anxiety (Talker Research, 2025).

So, is it okay to measure your happiness, self-worth, and success mainly by how much money you have?

The Happiness of Buying Stuff

Buying things will make us happier, many of us think. Kasser et al. (2007) confirmed that most people believe that acquiring material possessions is a good way to bring more happiness into life.

But the data doesn’t support what most people believe. Researchers have found that:

- Novel experiences and social connections give us more life satisfaction in the long term as compared to material possessions.

- How we spend our money is at least as important as how much money we make to matter for our happiness.

An interesting study done in India in 2001 found that the slum dwellers of Calcutta are more satisfied than one might expect, though they generally experienced a lower sense of life satisfaction than more affluent groups. One reason for this was that they put a strong emphasis on social relationships.

So, if happiness depends less on buying and owning things, how should you spend your money wisely to make yourself happier?

7 Ways To Spend Your Money When Shopping For Happiness

Here are 7 seven research-backed ways to spend your money for maximum happiness:

1. Buy Now, But Consume Later.

When you buy yourself an experience that happens in the future, you add to your happiness in three ways.

- First, when you’re going over the pictures and videos, plan out the perfect experience before you decide to buy it.

- Second, when you anticipate the enjoyment you will derive from the adventure, and spend days planning things.

- The third time you feel joy is when you go to enjoy the experience because it feels like you’re getting all of it for free.

Paying for an experience and going to the experience later takes away the pain of paying for instant pleasure.

When you use the ticket to an adventure that you bought a long time ago, you enjoy the experience more since your mind forgets the pain of paying for it.

- Let’s say you want to book a trip to Amsterdam. When you buy the package, paying for it hangs painfully in your mind.

- But after some time, you start to forget the pain, as you expect it to be the most spectacular vacation of your life. It is this anticipation that makes it joyful.

- Finally, when you visit Amsterdam, your mind gives the impression that you are on an all-expenses-paid vacation.

The joy we get from anticipating the future is known in French as se réjouir.

2. Buy More Experiences (Than Things).

We buy things to give ourselves happiness boosts. Despite knowing all too well that these spikes won’t last.

Buying material stuff is not only the wrong recipe for upping our well-being, but it may also decrease our happiness.

Materialistic pursuits have been linked to:

- less life satisfaction (Richins & Dawson, 1992),

- less gratitude and meaning in life (Kashdan & Breen, 2007),

- less happiness (Belk, 1985), and

- more depression and anxiety (Kasser & Ryan, 1993).

So, how to stop yourself from buying things you don’t need?

Try Mel Robbin’s five-second rule to walk away from the item or forgive yourself for not having it.

Philosophers have argued that we should spend money to get life experiences, not possessions. Seneca, the Stoic philosopher, said:

“Again, let us possess nothing that can be snatched from us to the great profit of a plotting foe. Let there be as little booty as possible on your person.” — Seneca

And this is what science says: Buying life experiences is a more cost-effective way to spend money for happiness.

- Several studies have found that life experiences, rather than material possessions, contribute more to happiness (Caprariello and Reis, 2013, Carter and Gilovich, 2010, Carter and Gilovich, 2012).

- In a survey of loan applicants by Dunn and Courtney (2020), more than 80% said they got more satisfaction after buying experiences like trips, concerts, or special dinners rather than spending on things like electronics or clothes.

Instead of buying things, spend your money on experiences that make you feel good about yourself, like time with friends, exercising, reading, or meditating.

Did you know there’s a happiness formula that’s based on research?

3. Buy Yourself Free Time.

We assume that rich people spend their time in happier ways, like living in costly apartments close to their offices.

But data shows wealthy people are busy doing things they don’t like. They spend more of their time on less enjoyable activities, like commuting and shopping (Kahneman and Krueger, 2006).

Research also indicates that higher incomes and an increased sense of time scarcity are related. So, in truth, as you get wealthier, you start to feel more pressed for time.

However, the good thing is, you can add to your happiness by buying yourself some spare time to do things you enjoy.

Recent research suggests that spending discretionary income to buy more leisure time may enhance happiness.

The study authors found that spending money on time-saving services, such as outsourcing cooking, shopping, and house cleaning, is related to better levels of life satisfaction (Whillans, Dunn, Smeets, Bekkers, 2017).

Spending money on time-saving services may feel extravagant in the current post-global outbreak era, yet buying time appears to increase happiness levels.

4. Spend Some Money On Others.

The happier people have a consistent pattern of spending their income:

- After paying for the essentials, they set aside away 25% for saving or investing.

- Then they spend roughly 12% of their earnings on pro-social activities, like donating to charities or religious institutions, or buying gifts for others.

A string of studies reveals that spending some of your money on someone else is more likely to make you happy than spending it on yourself.

Spending on others allows us to bask in the “warm glow” of giving.

However, the act of giving does not necessarily make everyone happy. For being happy, it is crucial that the givers feel that they made their decision freely — something they decided to do rather than being compelled to do.

Giving generously, even if it is only a few dollars, can improve your mood, according to research.

5. Go Shopping Without A List.

A shopping list is an ideal way to avoid impulse buying. It saves time and money, and also, lets you get the most out of your shopping trip.

But what happens when you walk into a supermarket with a shopping list in your pocket?

It becomes a chase to check off the items on your list. Buying from a shopping list is a mechanical and stressful experience.

Moreover, it might add more worry if you realize your list is missing key items.

So, don’t always bother making a list. Sometimes, allowing yourself to go on an impulsive shopping trip can fill you with the delights of curiosity and exploration.

It is an emotional experience when you go shopping without any prefixed plan or any plans to write down your purchases once you get home.

Impromptu shopping is mostly fun.

6. Pay For Shopping With Only Cash.

Nowadays, most people even use their phones as their wallets, with apps to make it that much easier. But is it really the better way to pay?

When you pay using a digital mode, the process is almost painless.

Using cash or bills is more difficult emotionally, but it saves you the later agony of having to settle your dues and debts.

These “invisible” modes of payment often lead you to buy things you don’t need, which you later regret when you get home.

Remember, going cashless while shopping can deliver unbounded joy at the time of purchase, but it may cause pain later.

So, take cash (or a card with a limited amount) with you when you go shopping.

The psychology of money says that when you pay with a credit card or a mobile wallet, you tend to spend more since you don’t feel the pain of seeing the money leave your pocket.

7. Never Get Into A Debt You Can’t Pay.

There is a dark side to spending invisible money:

- You buy to feel good, making sure these are low-priced items.

- Your credit card debts silently keep piling up throughout the month.

- It reaches a point where it breaks your capacity to make timely payments.

- Now you have “a debt problem without ever having borrowed money.”

We know how financial institutions deal with debtors. They can force you through intense suffering to extract their pound of flesh.

Debt can kill your happiness in some of the most painful ways.

So, to keep your peace of mind:

- pay off your debts as swiftly as you can, and

- avoid going into unpayable debt.

A debt is worse than borrowed money. Borrowing is planned and intended, while debt is unplanned and unintended.

The ‘Money To Survive’ Argument

When talking about money and happiness, most people reduce the argument to: you can’t put food on the table, pay your rent, or afford healthcare, without money.

Those are the most basic survival uses of money, but that is not all we need to thrive.

Money is essential for surviving, but insufficient for thriving.

- Having sufficient money is essential for our happiness. But beyond that point, it doesn’t help.

- So, while we think money will make us very happy for a long time, it only gives us a little happiness for a short time.

“Being preoccupied with the pursuit of money, wealth, and material possessions arguably fails as a strategy to increase pleasure and meaning in life. People with stronger materialistic values reported more negative emotions and less relatedness, autonomy, competence, gratitude, and meaning in life.” — Todd Kashdan & William Breen

We can source sustainable happiness from non-material sources — like meaningful experiences, good friends, and a sense of purpose in life.

Pursuing happiness, whether through means of money or otherwise, can actually make us unhappy.

More Shopping Does Not Assure More Happiness

More income increases our happiness. Money can help us afford admission into better schools, more rewarding careers, and safer residential localities.

But there is a catch. Money does not provide as much happiness as we like to believe.

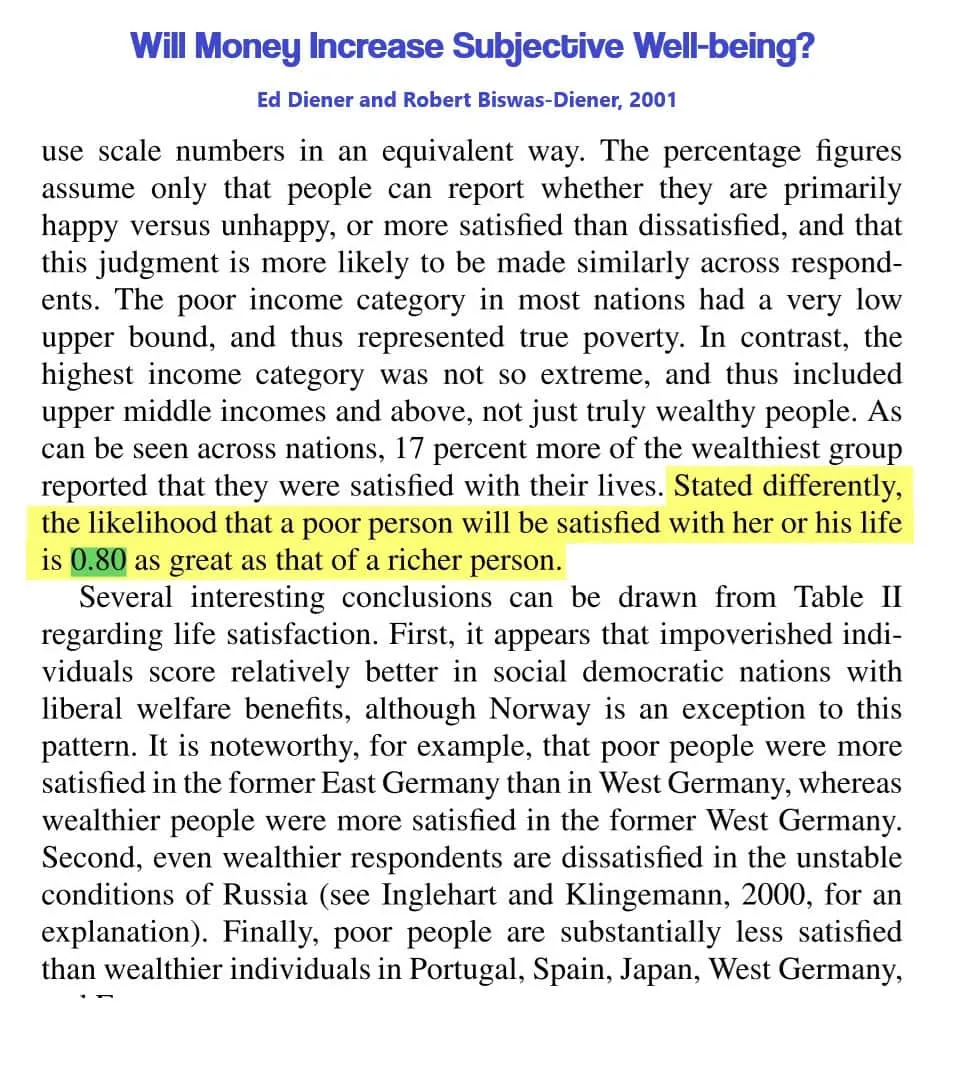

The difference in life satisfaction between the rich and the poor is only about 20%, as surveys across 19 countries found (Diener and Biswas-Diener, 2002).

- Having more money can make a bigger difference in happiness when people are struggling to meet their basic needs, like food and shelter.

- Once those needs are met, having more money doesn’t really boost happiness as much, especially as material desires increase with higher income levels.

That point, where money stops giving you more happiness, is called the happiness plateau.

The money that makes a person most happy is the money that keeps them out of poverty.

There’s another side to it: When we have more money, we want to buy more than we can live without. We give in to impulsive buying and enter overconsumption mode.

Overconsumption: This phenomenon is one of the main threats to the much-needed global sustainable transition. Because if everyone overconsumes, industries will overproduce. However, no one has enough resources to obtain every single product that has ever been made, so we begin to witness the accumulation of a ludicrous amount of surplus. Environmentally, this is an apocalypse scenario.

— Isil Gurmen, The Next Cartel

Final Words

In short, while money can help us feel happier, it’s not the whole story. What matters is how we spend it to meet our needs and values in life.

Many people dream of marrying into riches.

There even exists a bestselling genre of “billionaire romance” novels. These novels allow their readers to indulge their fantasies of shopping at high-end places and being seen in opulent places. Without any worries about how much they spend in a few hours or how much money they will have left after the purchases.

But, think for a while from the other side of the table: Do the wealthy feel happier than everyone else at all times? No.

Unlimited money is NOT the recipe for never-ending bliss.

Of course, more buying creates business, but it may also be a curse for our planet Earth. We must be mindful of how fast we consume resources and produce waste in comparison to how quickly nature can absorb our waste and generate resources.

Sonja Lyubomirsky, the author of The How of Happiness, warns us:

“Having money raises our aspirations about the happiness that we expect in our daily lives, and these raised aspirations can be toxic. Unfortunately, raised aspirations … steer us to consume too much, tax the planet’s resources, overspend, and under-save, go into debt, gamble, live beyond our means, and purchase mortgages that we can’t afford.”

• • •

√ Also Read: How To Be Financially Happy: 7 Habits of The Happy & Rich

√ Please share this if you found it helpful.

» You deserve happiness! Choosing therapy could be your best decision.

...

• Disclosure: Buying via our links earns us a small commission.